tax loss harvesting crypto

It has its benefits but it has its. 13000 price Max bought his bitcoin Fair market value.

Tax Loss Harvesting Understanding The Basics

Web Tax-loss harvesting is a legal investment strategy that helps reduce your overall capital gains for the financial year and as a result can reduce your taxes owed.

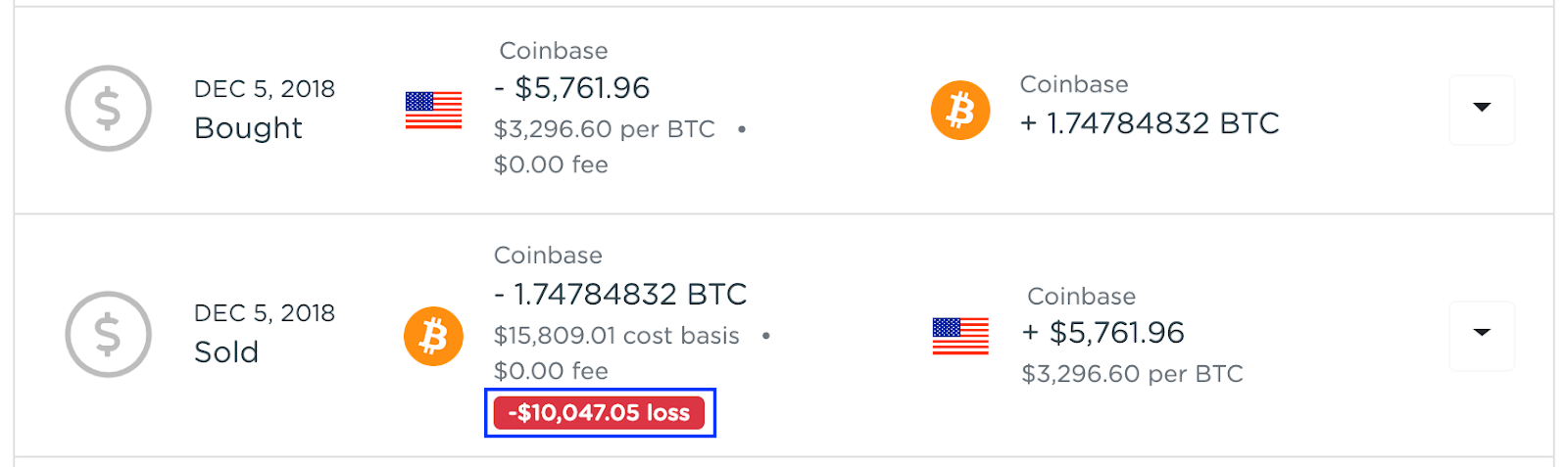

. Web Like many I lost a lot on all of my crypto investments this year so Im planning to do tax loss harvesting by selling everything then immediately buying it back and claiming it as a loss. Tax-loss harvesting TLH is performed to take a current-year tax deduction. You bought 1 BTC at 4000 and 1 BTC at 10000.

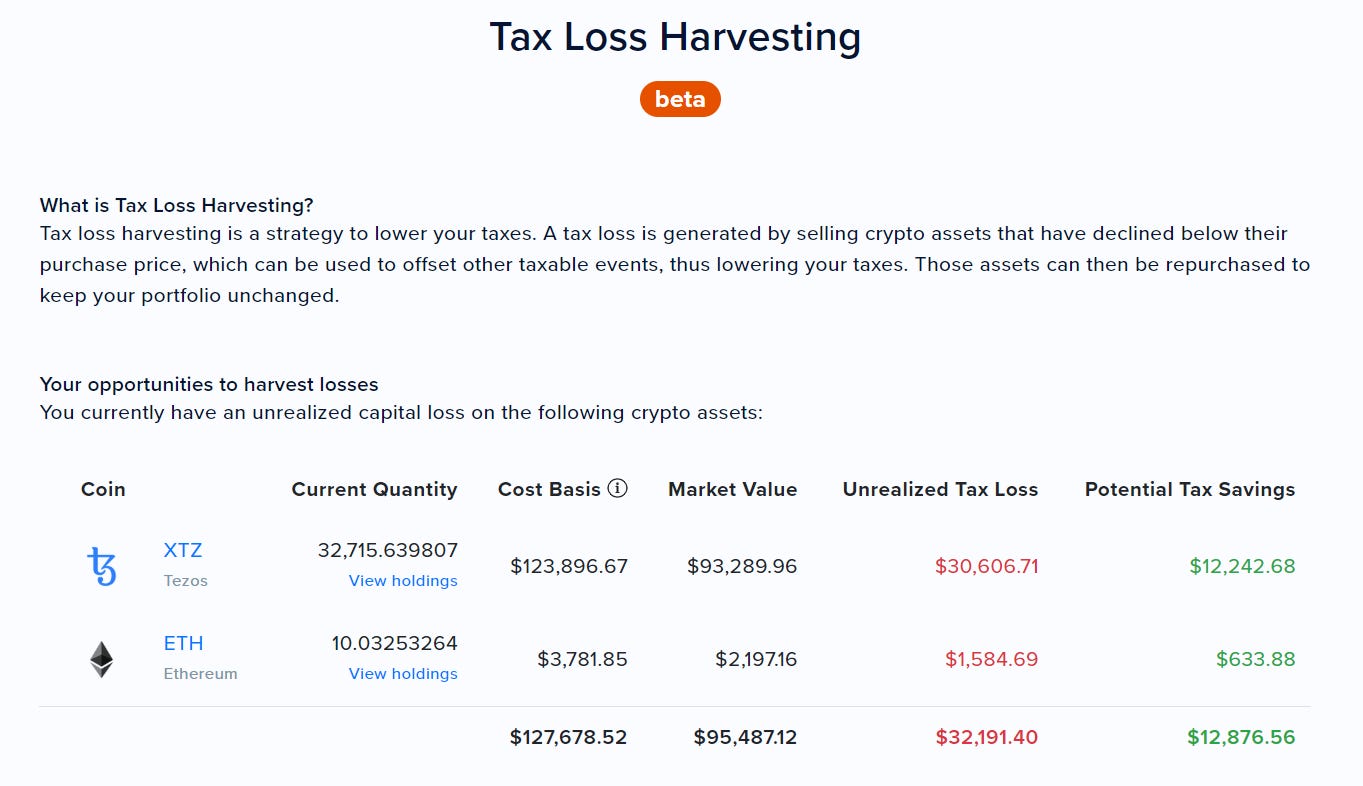

The investor can benefit from this situation through taxes on the capital. For instance if you invested in XRP at its peak of 3 which is. Once youve recorded all of your transactions youll be able to generate a tax report with the click of a button.

Two years later you sell the 2 BTC. Web Crypto tax-loss harvesting is a popular investment strategy that involves selling assets at a loss to effectively offset capital gains from other investments. The driving force behind tax-loss harvesting is the idea that an.

You can use this market environment to your advantage and pay LESS taxesIn this video I cover. A user needs to set up a free. Using the 3000 deduction McGee would be able to reduce his taxes by 1050 3000 035.

Web To see why this is tax efficient assume McGee has a 35 percent effective tax rate. Web Crypto tax loss harvesting can help you pay less tax on your crypto investments. 3 months later the value of 1.

Web The crypto market keeps fluctuating and hundreds of changes are taking place. Web This is tax-loss harvesting. Web Crypto Tax Loss Harvesting Risks.

Web Crypto Loss Harvesting. Web 2022 has been a rough go for asset prices. Web Heres how tax loss harvesting works for crypto.

Tax loss harvesting crypto with Koinly. Its legal - but there are some tricky rules you need to know. Web Example of a Crypto Tax Loss Harvesting Scenario.

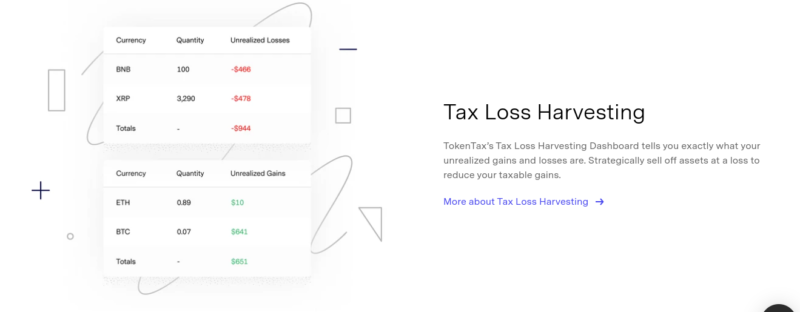

Web Crypto tax loss harvesting and wash sale rules sometimes come together in the conversation. Web Tax loss harvesting with unrealized gains and losses of the same crypto. Suppose you bought 2 Bitcoins for 5000 and 5 Ethereum for 9000 in 2019.

People who use this tax. Generate your tax report. Navigate to the tax-loss harvesting tab.

The Internal Revenue Service IRS. Web The crypto tax loss harvesting deadline in Australia is from 1st July 2021 to 30th June 2022. 7000 current price of Maxs bitcoin.

A 30-day wash sale rule is when you buy back substantially the same. Many of the popular projects from 2017 are trading at discounts of 90 or more. Web To learn what you need to know about tax-loss harvesting read on.

Crypto tax loss harvesting is legal but you as an investor have to adhere to the wash sale guidelines. Here is an example of crypto tax-loss harvesting. Web If your portfolio is underwater one of the easiest ways to save money is loss harvesting.

The tax benefit is not that large though. Tax-loss harvesting occurs when you sell assets for a loss to offset against. Web Capital Loss Deduction.

Victor bought 1 ETH for 4000 and 5000 DOGE for 500. BTC is now trading at 8000 so you have.

Tokentax Review A One Stop Solution For Your Crypto Tax Filings Jean Galea

6 Bull Run Tax Tips For 2020 By Ryan Sean Adams

Tax Loss Harvesting On Crypto Your Plan For The 2022 Fed Rate Hikes Marathon Digital Holdings Quick Rundown Goodbye 2021 Rogue Retirement Lounge

Got Losses On Stocks Bonds Or Crypto There S A Silver Lining At Tax Time Wsj

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Best Crypto Tax Software 2022 Reviewed Compared Hedgewithcrypto

How To Tax Loss Harvest With Cointracker Cointracker

Institutional Tax Loss Harvesting Weighs On The Bitcoin Price As 2021 Comes To A Close

Tax Loophole Wash Sale Rules Don T Apply To Bitcoin Ethereum Dogecoin

Cycling Cryptocurrency Investments Yields Bountiful Harvest Of Tax Losses Mclaughlinquinn Llc Rhode Island Boston Law Firm Tax Planning Resolution Irs Bankruptcy Business

Loophole Harvest Tax Losses On Bitcoin And Other Cryptocurrency

Tax Loss Harvesting In A Crypto Bear Market The Bitcointaxes Podcast

Investors Can Use Crypto Losses To Offset Capital Gains

Crypto And Tax Loss Harvesting Wash Sale Rules And The Benefits Downsides R Cryptocurrency

Cryptocurrency Archives Albion Financial Group

7 Best Crypto Tax Calculators 2022 Accounting Software Guide

Top 7 Ways To Avoid Taxes On Your Crypto Gains 2022

Financial Advisers Pitch Bitcoin To Investors To Offset Portfolio Losses Wsj

Harvesting Crypto Losses Just Got Easier Taxbit Releases Updates To Tax Optimizer Taxbit